09/03/20

For many years accounts payable processing has been a manual process. With hundreds, if not thousands of papers to process by hand, the room for error is tremendous, and the risks are simply difficult to justify.

Manual AP processing is also costly because it slows the process of paying vendors, and the obvious risks of human error and fraud, not to mention the liability of misplacing a document that may be useful later during an audit.

This is why companies need to embrace ePayables as a better automated alternative to process accounts payable. We think most, if not all, industries can benefit from automating their ap processing. But we have seen amazing results in savings and earnings, in industries such as logistics, medical, and construction.

Let’s see how epayables can make handling your accounting easier.

According to Ardent Partners’ report Accounts Payable Metrics that Matter in 2020, 62 percent of business executives say exceptions create slow processing times and reduce efficiency and effectiveness of AP processes. Also, 51 percent said lengthy invoice approval times were a major concern. Finally, 40 percent said “too much paper” was another.

More companies are already sending electronic invoices. The study found that 50.3 percent of companies send them electronically, and 55 percent of companies handle B2B payments this way.

But it’s still not enough.

Arden Partners suggests creating an AP game plan that revolves around two linked themes: “Solve most, if not all, of the tactical and manual-based issues that have plagued the function for decades, then … Develop and build an ‘intelligent’ function that uses its evolving business perception to engage more stakeholders, gain greater investment, and support better business outcomes through intelligence-based insights.”

Digital invoice processing and payment cut down on time spent on AP functions.

Just think of the typical lifecycle of an invoice:

Unfortunately, this old way of doing things has a lot of roadblocks.

There is a built-in approval process for when you receive invoices. Similar approvals are necessary to sign checks, and when vendors receive the checks. This slows down the process considerably. That is, of course, whether a manager is even around to approve.

ePayables eliminate these roadblocks by automating the steps in the process. You don’t have to enter and approve invoices manually. Instead, digital payment methods make it easier for payment processing and reconciliation.

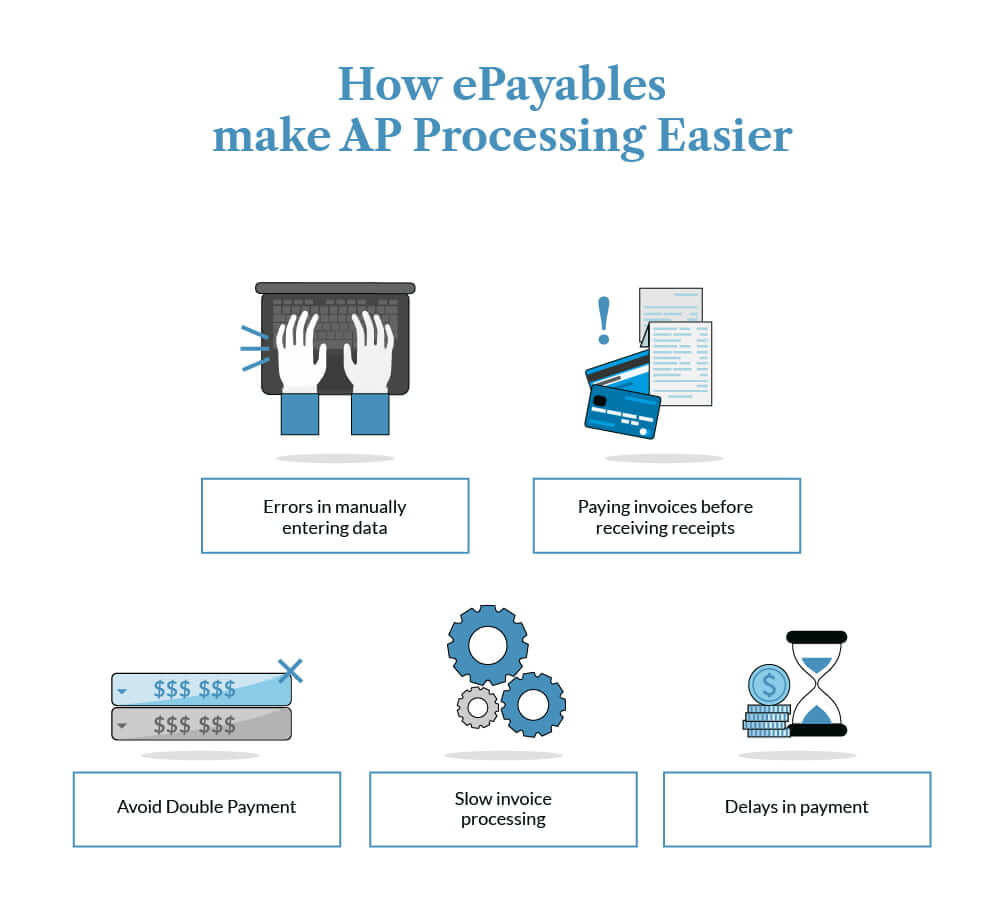

ePayables makes AP processing easier because it eliminates the opportunities to make manual mistakes, and the difficult processing of manually fixing those mistakes.

A great article by the G2 Learning Hub titled “5 Types of Accounts Payable Errors (+How to Minimize Them)” makes it clear as day that errors in normal AP processing are all human-related. To summarize, those mistakes are:

Those errors are all related mistakes that employees make. The good news is they can all be eliminated by a transition to ePayables.

Once your ePayables system is set up, there will no longer be the need to process most invoices on a manual basis. That removes a significant amount of error possibilities, which cuts down on the costs and headaches associated with identifying problems, creating a solution to the problem and figuring out ways to minimize similar problems in the future.

With ePayables, most steps in the AP process will be automated. That removes the potential for these human errors, which leads to a direct boost in your AP productivity, lowering the cost for every invoice you process.

Of course, the side benefit of this is that it frees up valuable time for your AP team members to handle something more pressing than typing in basic invoice data.

Transitioning to ePayables can seem like a daunting task, but it doesn’t have to be. The biggest challenge obstacle to overcome, in fact, is taking the first step to move in a digital direction.

Trying to complete the process on your own can prove to be difficult, if not impossible. It’s costly to do so — if it’s even possible — and those manual errors you were experiencing in the past with paper AP processing can rear their ugly heads again.

BluePenguin can help you take the guesswork out of ePayables. They can customize and create an ePayables solution that will work best for your company, helping you save money and be more efficient in the long run.

Contact BluePenguin today to get moving in the right direction.

Back to News and Articles