07/22/20

Company executives don’t often think of Accounts Payable (AP) as a profit center. Why should they make you money? AP deals with paying debts, after all, so it’s only natural to think of payables as an expense.

Viewing AP as a profit center might be a tough concept to grasp at first. But it’s easy to realize the potential of integrating analytics and automation.

Your AP costs are not fixed by the amounts listed on your various invoices. Your company’s total AP costs are based on many factors, such as:

Adjusting your approach to AP to integrate new processes and automation can save a lot of money in the long run. This, in turn, can significantly increase your company’s profit.

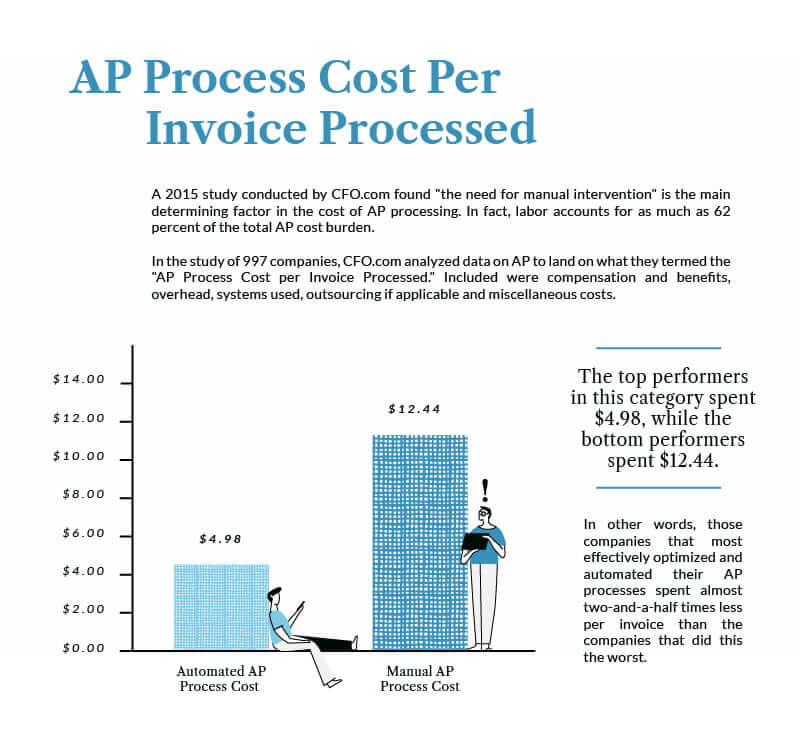

A 2015 study conducted by CFO.com found “the need for manual intervention” is the main determining factor in the cost of AP processing. In fact, labor accounts for as much as 62 percent of the total AP cost burden.

In the study of 997 companies, CFO.com analyzed data on AP to land on what they termed the “AP Process Cost per Invoice Processed.” Included were compensation and benefits, overhead, systems used, outsourcing if applicable and miscellaneous costs.

The top performers in this category spent $4.98, while the bottom performers spent $12.44.

In other words, those companies that most effectively optimized and automated their AP processes spent almost two-and-a-half times less per invoice than the companies that did this the worst.

To turn your AP into a profit center, you need to start by collecting as many data points as possible. This will get all your financial information in one place.

Then, analyze the data, looking for any inefficiencies or consistent gratuitous errors. Investigate whether the AP software you’re using is the right fit for your needs. If not, search for a new vendor.

Once you’ve analyzed your data and optimized your systems, you’ll be able to use this information for important tasks such as cash forecasting and pay scheduling so you’re always operating with sufficient cash flow.

This process will also allow you to make decisions in real-time going forward.

The first step in doing so is partnering with a company such as BluePenguin to get you on the right path.

There are innumerable benefits to automating as much of the AP process as you can. Some of these benefits are passive, while others are active.

Automating AP processes can save on operational costs. These include collecting, entering, and processing invoices and payments. With this, there is an actual labor cost for employees to do the work. There’s also an opportunity cost for what else they could be doing that’s more productive.

Automation can help you cut down on the costs of human error. This includes things such as over-paying on an invoice, plus the cost of spending time to go back and fix any errors.

The built-in security of the technologies you’ll be using for the automation can also help mitigate the costly impact of fraud, plus the negative impact it could have on your company’s reputation if fraud were to happen.

Finally, automation can improve the relationship you have with your vendors as the result of payments being made correctly and on time.

A 2019 Pymts.com study found that 81 percent of corporate financial decision-makers think AP automation could lower costs.

On average, an invoice takes more than eight days to process, according to the study. This is valuable time that can mean the difference between paying on time, incurring a late fee, or even getting a discount from your vendors for paying early.

By automating the AP process, invoices can be entered, analyzed, and paid without the need for manual functions. This can go a long way in boosting your bottom line by taking advantage of every available discount, and by avoiding costly late fees that can sometimes occur from simple human error.

One other side benefit of AP automation is that it enables you to go digital with your payments. You’ll be able to use a virtual payment card or ACH program to pay your invoices, instead of paying by paper check or cash. The benefit of doing this is it’s a more secure form of payment with a digital receipt trail, and it can help you take advantage of lucrative cash back or other rewards that digital payment methods offer.

By re-imagining your AP for 2020 and beyond, you can take a part of your business that’s often seen as a liability and turn it into an asset. A full-on digital transformation of your AP processes can help you become more efficient and more effective at managing your invoices.

In the process, you’ll be optimizing your labor hours, reducing human error, making decisions in real-time, and taking advantage of every discount and payment benefit at your disposal — all while making your relationship with your vendors even better.

We help companies of all sizes transform AP into an efficient profit center. Contact us to see if we might be able to help you.

Back to News and Articles