10/06/20

B2B payment fraud is on the rise.

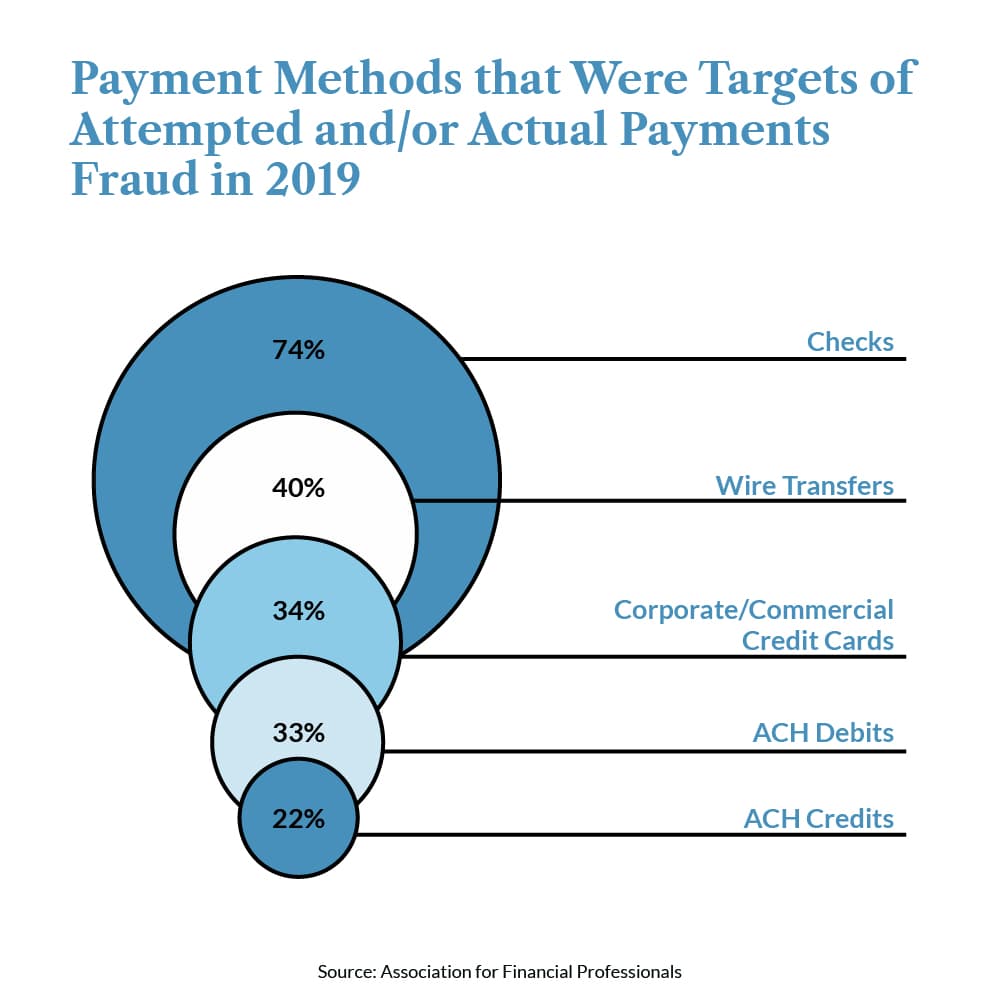

In 2019, 81% of organizations reported they were the target of an actual or attempted payments fraud. That year marked the second highest rate since 2009, with only 2018’s 82% level being higher.

Hackers are increasingly targeting the most susceptible line of communication (email). In addition, they are also targeting the most susceptible form of payment (paper checks).

In fact, the highest source of this fraud or attempted fraud was paper checks. And it was by a wide margin, too.

A high 74% of companies said check payment methods were the subject of fraud in 2019. The next closest payment method was wire transfers (40%).

Paper checks are not only inconvenient and inefficient to use in today’s business world. They are also much less safe and secure. They are susceptible to both external and internal fraud.

But why?

There are many reasons. Let’s take a look at a few.

One of the biggest reasons that check fraud makes up 47% of overall fraud losses for banks is they are touched by so many people. A paper check is not a direct form of payment. Unless you hand a check directly to the vendor, it will pass through many roadblocks on its way to the vendor’s account.

Here is the typical lifecycle of a check, from initial writing to depositing:

There are multiple opportunities for fraud to occur at each step in this process. Any of the people involved in these steps could attempt fraud. Or, the mail could be stolen or compromised by a bad actor.

Another huge downside to paper checks is they have your bank account information printed right on them. Even if someone doesn’t physically steal your check, they could easily write down your account and routing numbers and use them later.

Of course, credit cards have similar problems. The 16-digit account number is printed right on them. So, what’s the difference between the two?

The main difference is what happens when fraud is committed.

With paper check fraud, money comes directly out of your bank account. That money is not available to you until the fraud investigation is complete.

Since paper checks give a bad actor access to your actual bank account, the amount of money they can steal is limited only by what you have in your account. In other words, they have a direct way to debilitate your business.

With credit card fraud, the financial institution can simply set that money on your balance aside as they investigate. You won’t lose any actual money from your account in the meantime.

Credit cards also have limits on them. So, there’s only so much fraud someone could attempt. Credit card fraud also won’t have any direct effect on your company’s cashflow.

Unlike digital payment methods, paper checks can be manipulated. Skilled bad actors can forget a signature. They can forget an endorsement. They can alter the dollar amount of the check or the payee name.

By changing the payee name, the bad actor can direct the check payment directly to them. Bank tellers will be none the wiser, as the check that the bad actor presents to them will look legitimate.

This can’t be done with digital payment forms. Since the B2B payment can’t be manipulated, it reduces the chance that someone can access it.

One of the biggest advantages of the digital world is the added levels of security. This is a huge benefit of making B2B payments digitally.

Digital payments have layers of encryption that makes it very hard for hackers to access. This reduces the likelihood that your accounts can be accessed. Payments won’t even have account information associated with them.

Meanwhile, the “security” of paper checks is basically only the trust you place in the people handling the check. Sure, the bank protects you against fraud up to a certain limit. But undoing that fraud is expensive when it comes to paper checks because you lose actual money for some time.

This problem has become accentuated even more by the coronavirus pandemic. Some AP employees have been forced to physically take check printing machines home with them so companies can continue paying vendors. This adds yet another layer to the potential fraud for paper checks.

The pandemic will eventually end, of course. But, it has most likely ushered in a new era of remote work. So, this is something companies will have to address for the long-term.

The best way to mitigate fraud attempts and successful fraud for B2B payments is to transition to ePayables. By going completely digital with your payments, you’ll be adding a huge layer of safety and security to all your transactions.

While substituting credit cards for paper checks is a good first step, ePayables are the safest and secure way to make B2B payments today. No one will have access to account numbers of any physical payment form with ePayables. This future-proofs payment for remote work, as well.

If you’re ready to make the transition to payables, BluePenguin can help. Contact us today to see how you can protect yourself against B2B payment fraud, while optimizing your AP department for efficiency.

Back to News and Articles